Climate Prediction Markets: Can We Bet on the Future of Our Planet?

This blog post discusses the concept of climate prediction markets. #ClimatePrediction #PredictionMarkets #Risk #Climate #WeatherVsClimate #Forecasting

When you check the weather forecast, you’re relying on a system that’s been honed over decades [1]. Meteorologists use mountains of data, sophisticated models, and, crucially, constant feedback. If a forecast is wrong, we know within days, and the models can be tweaked. But what happens when we try to predict the climate, not just next week’s weather? And what if we could use markets, not just models, to improve those predictions?

This is precisely what climate prediction markets aim to do.

The Difference Between Weather and Climate Prediction

Weather prediction is a data-rich, short-term game. Every day, millions of observations pour in from satellites, weather stations, and balloons. Forecasts are tested against reality within hours or days. This rapid feedback loop allows meteorologists to refine their models and improve accuracy over time. As highlighted in the CAHM24 Weather Prediction Markets paper published in the Bulletin of the American Meteorological Society, the ability to validate predictions quickly is a cornerstone of progress in weather forecasting [2].

Climate prediction, on the other hand, is a different beast. Climate models aim to forecast changes over decades or even centuries. The feedback loop is glacially slow—by the time we know if a 30-year prediction was accurate, the world has changed, the models have evolved, and the people who made the prediction may have retired. The CAHM24 paper points out that this lack of timely validation makes it much harder to know which models or experts to trust [2].

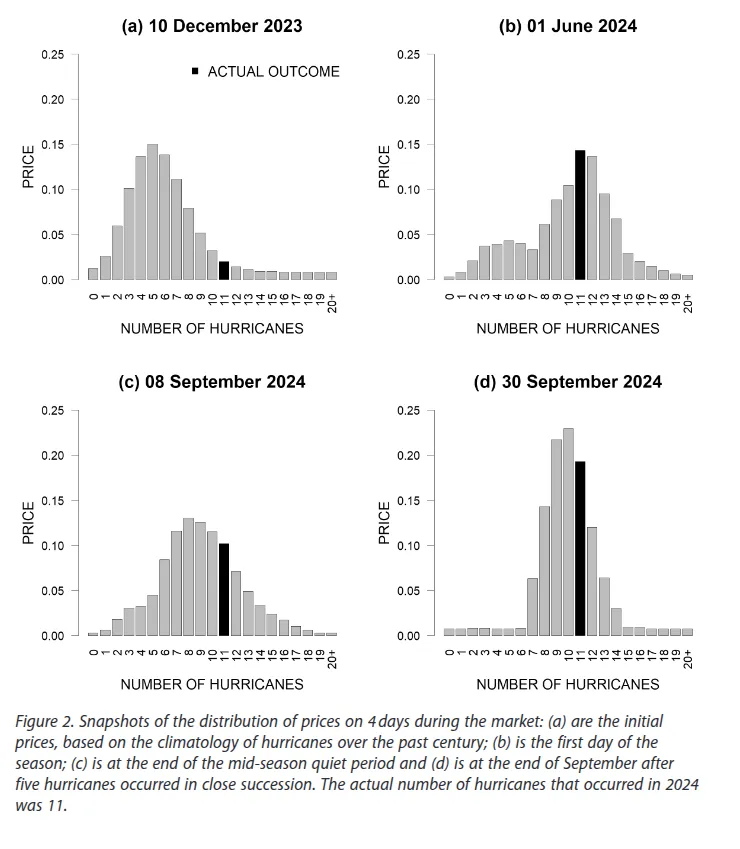

Snapshots of the CAHM 24 competition showing the evolving probability distribution for the number of hurricanes in the 2024 Atlantic season.

Snapshots of the CAHM 24 competition showing the evolving probability distribution for the number of hurricanes in the 2024 Atlantic season.

Enter Prediction Markets

Prediction markets are platforms where people can bet on the outcome of future events. They’ve been used to forecast everything from elections to Oscar winners, and they often outperform traditional polls or expert panels. The idea is simple: if you have skin in the game, you’ll work harder to get the answer right. A recent webinar introduces the concept and its application to climate prediction [3].

But can this approach work for climate? In the video referenced above, experts discuss the potential and pitfalls of climate prediction markets. The hope is that by aggregating the wisdom (and incentives) of many participants, we might get better forecasts—or at least a clearer sense of what the "market" thinks will happen.

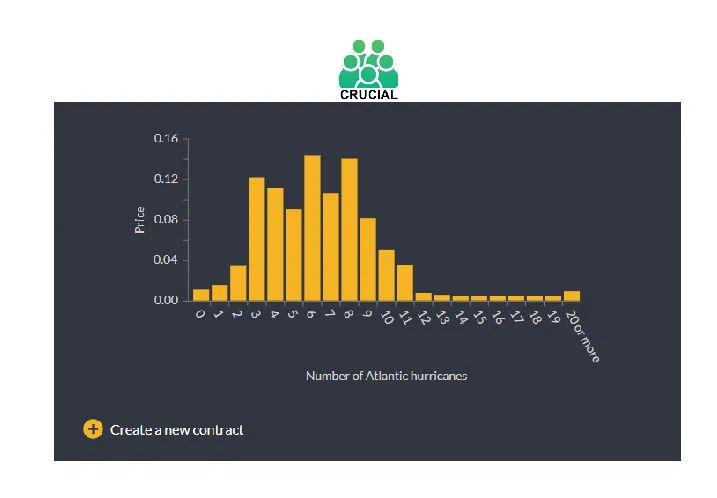

The CRUCIAL initiative has piloted expert prediction markets for climate-related risks, such as the number of hurricanes in a given season [4]. In these markets, participants allocate credits to different outcomes (e.g., the total number of hurricanes), and the market price reflects the aggregated beliefs of the participants, using the AGORA platform developed by the CRUCIAL initiative [5].

Snapshot of the AGORA platform (see the user guide for more details [5]).

Snapshot of the AGORA platform (see the user guide for more details [5]).

The Validation Problem

Here’s the catch: prediction markets thrive on feedback. If you bet on tomorrow’s rain, you’ll know if you were right within 24 hours. But if you bet on the global temperature in 2050, you’ll be waiting a lifetime for your payout. This makes climate prediction markets fundamentally different from weather markets. Without timely validation, it’s hard to know if the market is actually "learning" or just echoing the loudest voices.

The CAHM24 paper emphasizes that, for weather, the constant stream of new data allows for rapid iteration and improvement [2]. For climate, the data comes too slowly to allow for this kind of learning. The CAHM24 paper explores how prediction markets might be structured to deal with this, perhaps by focusing on shorter-term, intermediate outcomes that can be validated more quickly [2].

Challenges for Climate Prediction Markets

Despite their promise, climate prediction markets face several structural challenges:

- Validation lag: As discussed above, the long timescales of climate prediction mean that it can take years to know whether a forecast was accurate. This limits the ability of markets to reward skill and improve over time.

- Liquidity and participation: Specialized markets, such as those for climate outcomes, often struggle to attract enough participants to ensure robust price discovery (see the CRUCIAL webinar discussion [3]).

- Defining outcomes: For a market to function, the outcome must be well-defined and verifiable. For long-term climate variables, this can be challenging, especially if data sources or definitions change over time.

Why Bother?

Despite these challenges, climate prediction markets could still play a valuable role. They might help us identify which scenarios experts (and the public) see as most likely, or reveal where there’s the most disagreement. They could also incentivize the development of better models and more transparent data.

But we should be clear-eyed about their limitations. As the video and papers make clear, the lack of timely validation means that climate prediction markets will never be as robust or reliable as their weather counterparts. Still, in a world where climate decisions are urgent and the stakes are high, even imperfect signals can be valuable.

Conclusion

Weather prediction is a triumph of data, models, and rapid feedback. Climate prediction is a leap into the unknown, with validation that comes too late to help. Prediction markets offer a tantalizing way to harness collective intelligence, but they face unique challenges in the climate space. As we look for new ways to understand and prepare for our planet’s future, we’ll need to combine the best of science, markets, and humility.